On the website of the Ministry of Finance (MF) has been published another package of legislative proposals in connection with the announced Polish New Deal. This time, the proposals of the MF will concern transfer pricing. In principle, the aim of the proposed changes is to make it easier for taxpayers to meet their transfer pricing obligations. However, among the announced changes the MF also proposes solutions that in their present form may potentially broaden the scope of TP obligations.

At the moment, the draft amendments proposed by the MF are at the stage of pre-consultations. Therefore, the final form of the proposal may be subject to significant changes. ASB actively participates in the ongoing consultation process, proposing its own legislative solutions, positive for taxpayers.

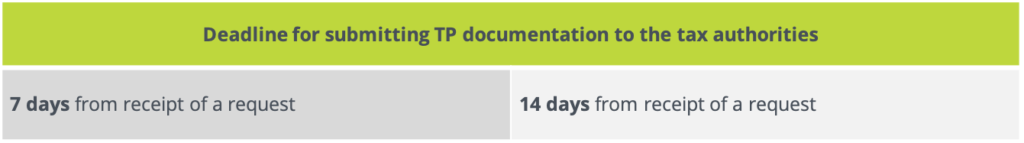

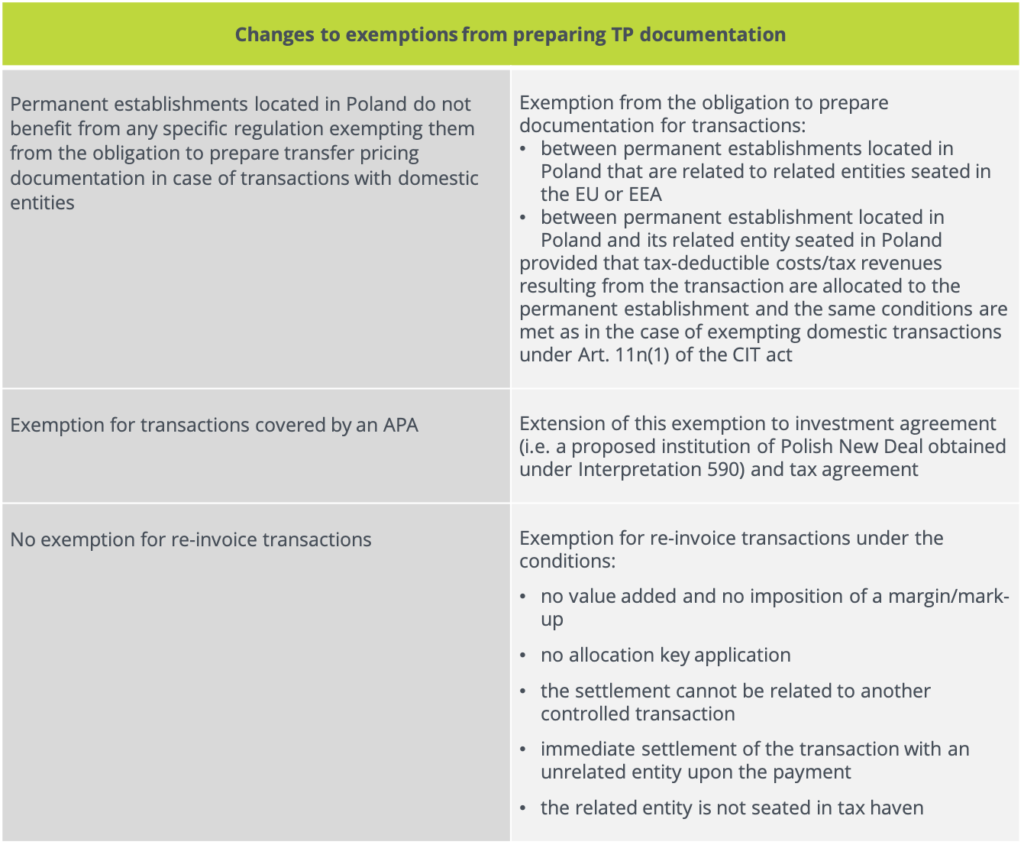

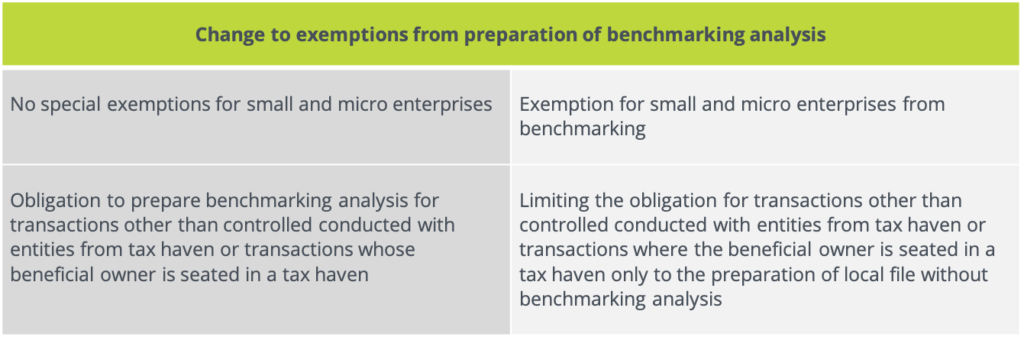

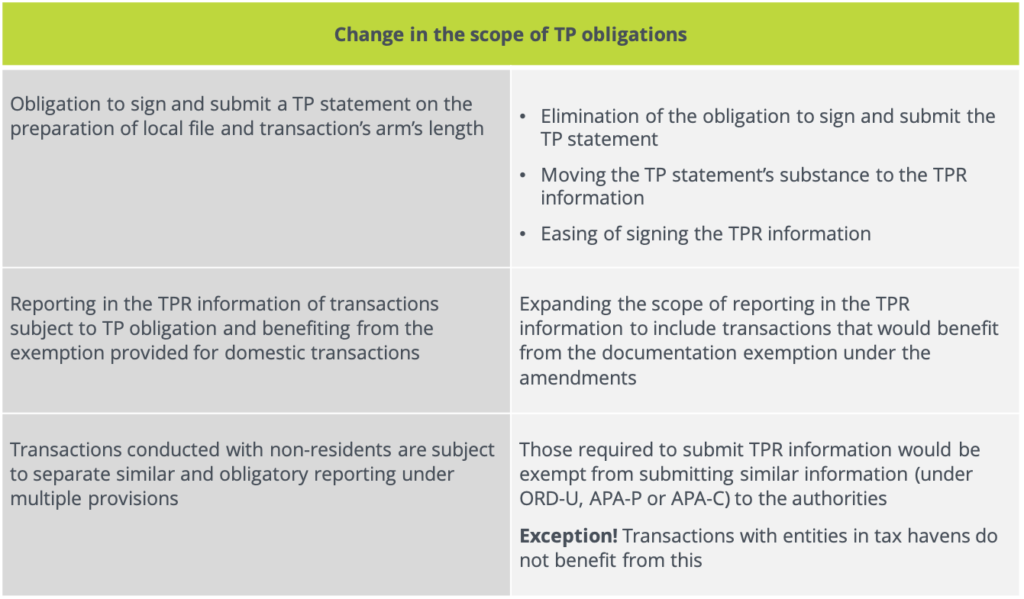

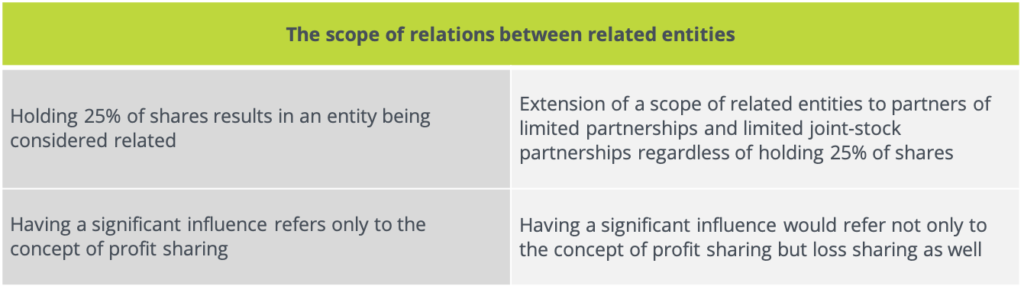

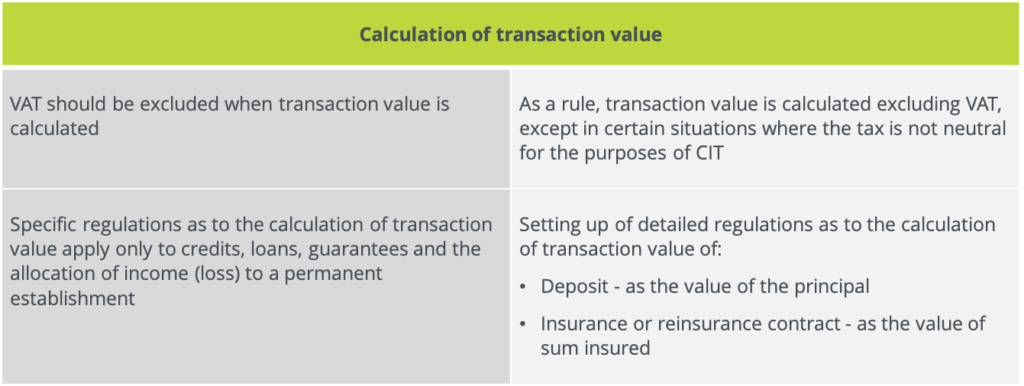

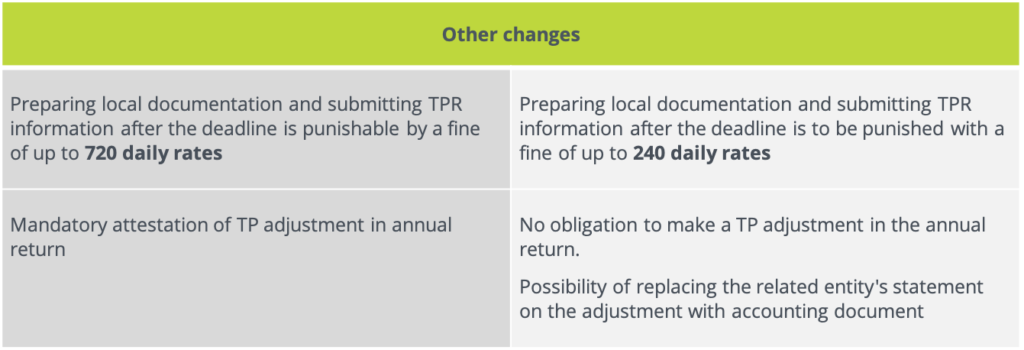

Below we present a summary of the most important possible changes indicating their current form and the MF’s proposals.

Piotr Szeliga

Tax Manager, Tax Adviser, Attorney-at-law

E: pszeliga@asbgroup.eu