At the end of January, the Ministry of Finance (MF) published the most up-to-date statistics related to the Advance Pricing Agreements (APA) procedure. Updated as of 31 December 2020, the data summarises already 15 years of this legislation in Poland.

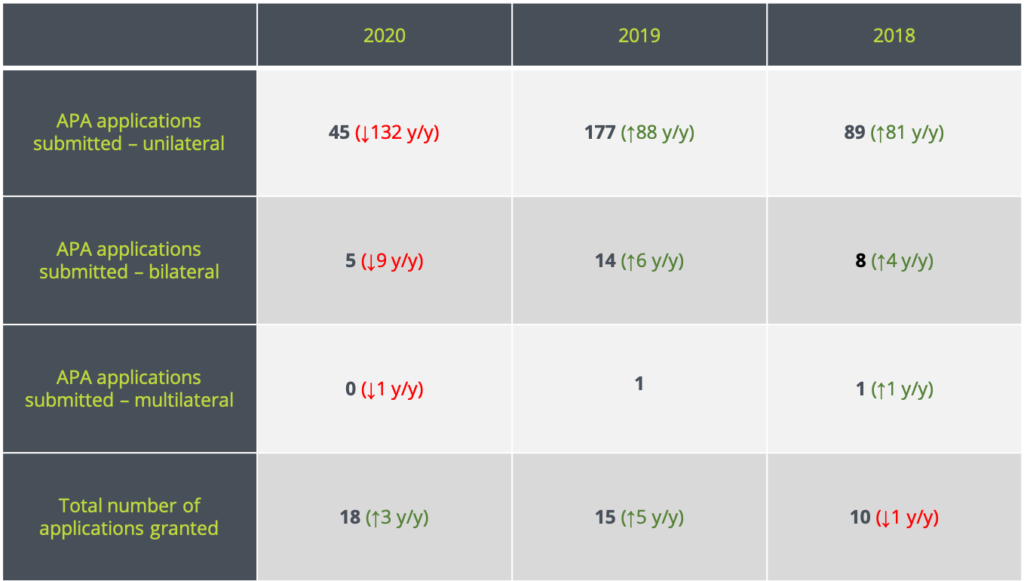

For several years, the number of pricing agreements concluded by the MF with taxpayers has been steadily increasing. Unfortunately, the increase does not correspond with the high interest of taxpayers in this instrument. Compared to 2019, the authorities in 2020 improved their statistics of successfully closed cases from 15 to 18. Meanwhile, 50 APA applications were filed in 2020 alone. However, it is not a record result. Comparing with 2019 (192 applications filed) or 2018 (98 applications filed), the number of applications has dropped.

A higher number of applications filed in previous years can be explained primarily by the possibility to avoid the limitation of the inclusion of intangible services in the tax-deductible costs provided for in Article 15e of the CIT Act. Indeed, it is worth recalling that until the end of 2019 it was possible to submit an application for APA which, if granted, would allow for full deduction of costs incurred from 1 January 2018. In addition, the uncertain economic situation related to the pandemic was undoubtedly a factor inhibiting the number of applications submitted, which, due to the high cost of obtaining APA, resulted in a lower number of applications. Apparently, new applications were also not favoured by the change in APA provisions transferred from the Tax Ordinance to the new APA/DMR Act.

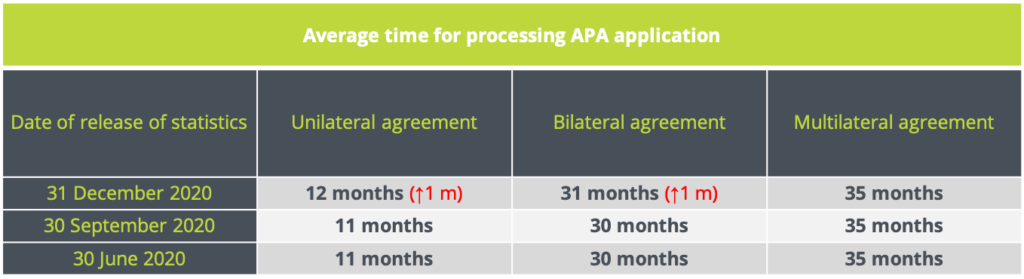

According to the information in the table below, the MF has also estimated the processing time for a single APA application, which has unfortunately increased in 2020.

Entities that are yet to apply for APA, but also all those that have already done so must be patient. Nevertheless, it is to be hoped that the steps taken by the MF to recruit new staff in the departments dealing with APA applications will contribute to speeding up the reviews.

It is worth mentioning that during the 15 years of functioning of the APA procedure in Poland, 37 decisions concerning, inter alia, discontinuance of proceedings or leaving the application without consideration were issued. Thus, in view of 98 agreements concluded in this period, it should be emphasised that almost 1/3 of decisions made by the authorities were not to the taxpayers’ liking. With such statistics and numbers, it is worth using the services of professional advisors. Otherwise, the chance of getting stuck in complicated regulations and after many years finding out that the resources and effort involved did not turn into success is much higher.

Piotr Szeliga

Tax Manager – Tax Adviser

E: pszeliga@asbgroup.eu

Łukasz Komorowski

Senior Tax Consultant

E: lkomorowski@asbgroup.eu

Dominik Piłat

Junior Tax Consultant

E: dpilat@asbgroup.eu